During August, the market reached new all-time highs, up 1.7% excluding dividends and 2% with dividends included. The total return, including dividends, has been nearly 17% during the past year-to-date. US Fed Chair Powell’s comments at the Jackson Hole conference were perceived to be dovish, suggesting interest rates will be going lower, provided impetus to share market returns.

S&P ASX 200 Net Total Return Accumulation Index (1 Year)

Index Performance

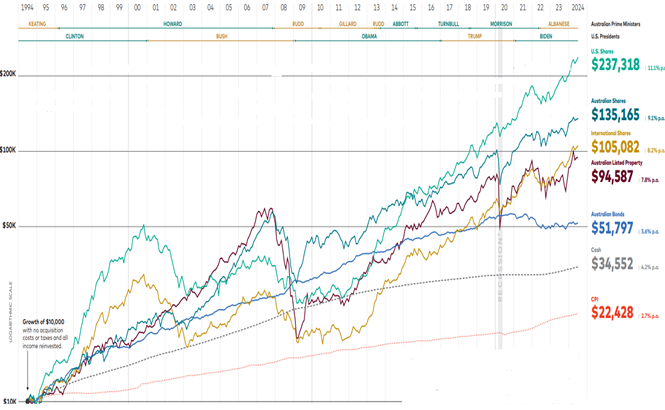

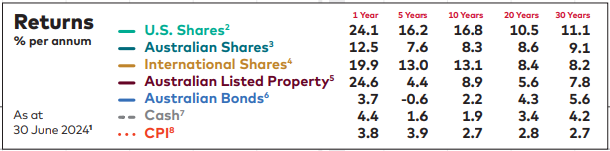

Following is a summary of various indices since 1994:

- 11.1% p.a. : US Shares : S&P 500 Total Return Index in AUD)

- 9.10% p.a. : Aust Shares : S&P/ASX All Ordinaries Total Return Index)

- 8.20% p.a. : Intl. Shares : MSCI World ex-Aust. Total Return Index AUD Index)

- 7.80% p.a. : Aust Listed Property : S&P/ASX 200 A-REIT Total Return Index

- 5.60% p.a. : Aust Bonds : Bloomberg AusBond Composite 0+ Yr Index

- 4.2% p.a. : Cash : Bloomberg AusBond Bank Bill Index

- 2.7% p.a. : CPI : ABS Consumer Price Index

Source: Vanguard

US stock market has risen 11.1% pa, better than the Australian domestic market, up 9.1% pa. The US market outperformance is driven largely by the mega-cap technology companies which make up 31% of the index. The Australia index has outperformed many other indexes, including other international shares, up 8.2%. Other asset classes include Australian listed property, up 7.8% pa, Australian bonds up 5.6% pa, and cash paying 4.2% pa.

US S&P 500 – TOP 10 HOLDINGS (by weight) (%)

| APPLE INC | 6.88% |

| MICROSOFT CORP | 6.68% |

| NVIDIA CORP | 6.19% |

| AMAZON COM INC | 3.68% |

| ALPHABET INC | 3.99% |

| META PLATFORMS INC | 2.24% |

| BERKSHIRE HATHAWAY | 1.71% |

| BROADCOM INC | 1.50% |

| TESLA INC | 1.38% |

| Total of Portfolio | 34.25% |

Reporting Season Comment

Earnings results to date have been fairly evenly spread between ‘beats’ and ‘misses’, however, company management ‘guidance’ has been conservative, continuing to reset earnings expectations a little lower for the next period. Please contact your adviser at Leyland Private Asset Management if you have any questions regarding reporting season.

Alex Leyland