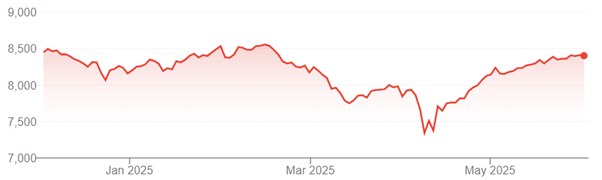

During the month, the ASX has risen about 3.5%, reversing much of the weakness following the US tariff’s announcement and the daily barrage of policy decisions from the Trump administration. Tariff uncertainty continues to create confusion globally and is delaying many business decisions until more clarity is achieved. Company executives are increasingly expressing concern, as most recently seen by the CEO of Nvidia, Jensen Huang, at a recent earnings update.

ASX 1-Month (excl divs)

ASX 6-Month (excl divs)

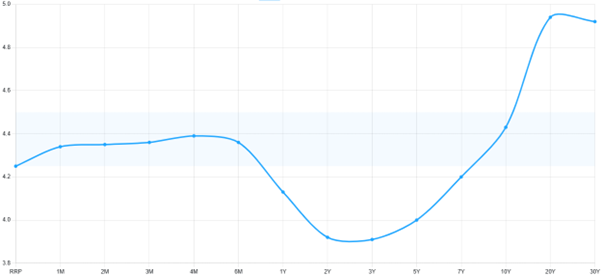

Over the past few years, companies with high levels of debt have been adversely impacted by rising interest rates, increasing serviceability costs. This is now reversing with rates appearing to be reducing.

In the US, government debt continues to rise. The current level of US debt is $US36.2 trillion, with $2.6bn being paid daily in interest alone. All three major rating agencies, Standard & Poor’s (downgraded in 2011), Finch (downgraded in 2023) and now Moody’s believe that the US Treasury no longer deserve their top rating. Regardless, the first major piece of legislation through the US parliament was a $4 trillion increase to the debt ceiling. So much for DOGE war on debt and deficits. This acceleration in spending is inflationary and the yield on US 10-year treasuries has increased. We are seeing the inflationary impact of increasing money supply on asset prices, including shares.

US Treasury Yield Curve

This impacts the Australian market, as the US is a bell-weather for the global economy, accounting for about 25% of global GDP. Although interest rates have fallen recently in the US, Europe and Australia, economists expect this to reverse in time. Interest rates impact on equity markets as they affect company debt servicing capabilities as well as the relative attractiveness, or lack thereof, of equities versus other assets including fixed income investments. .

Alex Leyland