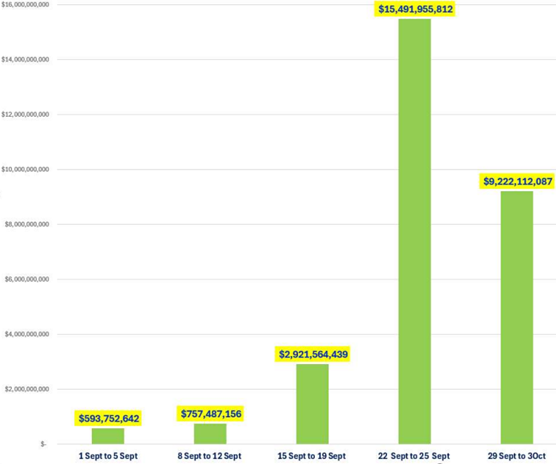

Over the past month, the ASX 200 has declined about 0.75%, not including dividends of around $25bn paid to investors during September. When adding dividends back, investors are up again over the past month.

Dividends Paid this Month (per week)

Source: Coppo

The market remains resilient despite some negative stock and sector specific news.

Energy stocks were hit when a proposed takeover of Santos by an Abu Dhabi‑US consortium (XRG: ADNOC & Carlyle) was withdrawn. Santos dropped significantly as a result, dragging down the energy sector.

The ANZ bank has agreed to pay a large penalty (~A$240 million) after ASIC found misconduct relating to a government bond deal, plus customer service failures. This has weighed on investor sentiment in the banking sector.

CSL is the third largest company in Australia, has dropped nearly 26% since reporting (6% in the past month). Impacts of US tariffs on pharmaceuticals is impacting confidence in the Healthcare sector. RFK Junior, the USA Secretary of Health and Human Services, is harassing vaccine companies and any non-US health providers, which may have added to downward pressure on the share price. In the past two years, CSL has dropped 34%. Historically, CSL was formed in 1916 and one of its first tasks was to create a vaccine for the Spanish flu. It was listed is 1994 at a price of $2.30.

U.S. rate cuts (or expectations thereof) and global inflation dynamics feed into Australian markets via capital flows, risk sentiment, and exchange rates. This rate cut contributed to the 25th record close for the S&P500 this year, which is unprecedented.

Alex Leyland