The adjectives used to describe the last month have been exhausted by the daily papers, so we’ll do our best to avoid these.

Observations from the last month – some of which are contradictory:

- Spending on alcohol and tobacco has increased

- Spending on online gambling has increased

- General spending has decreased

- Newspaper subscriptions have doubled

What does this tell us about the human condition? Perhaps only that a leopard doesn’t lose his spots, but perhaps the size changes. i.e. those who like to read have had the chance to indulge in this pastime more heavily, and those who like to imbibe have done likewise.

The unanswerable question to which everyone would like an answer is, what the world will look like in 3 months, 6 months, 1 year, 3 years and beyond?

The future is unknowable, but we can learn lessons from human behaviour.

Never before in history has the increase in the quality of living been greater than the last 100 years.

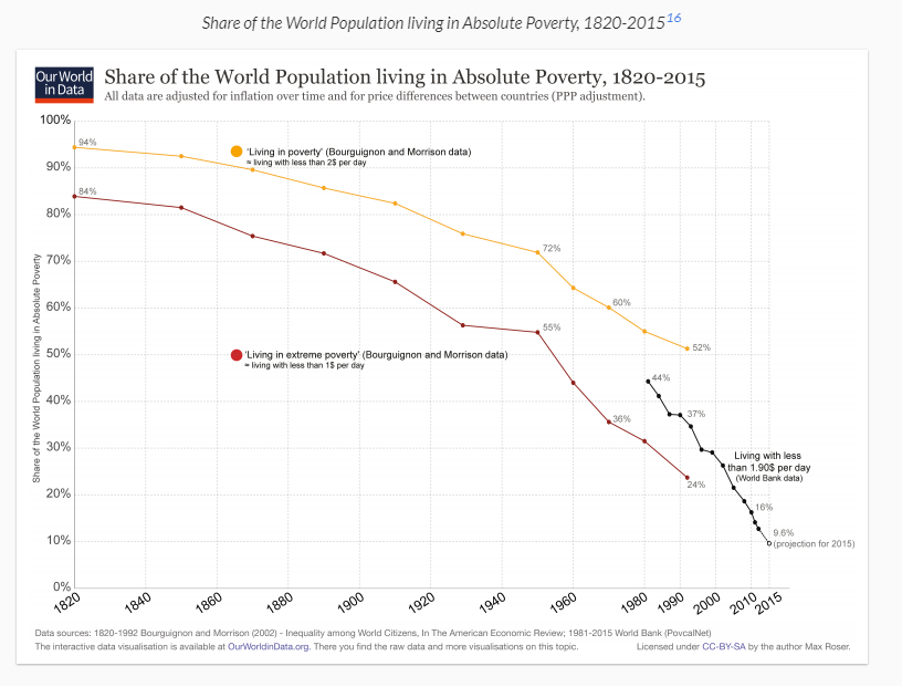

Global poverty has fallen dramatically:

Whilst there is much debate about the wealth gap, the gap in lifestyle has never been smaller.

Most can afford electricity, heating, cooling, running water, communication, transportation, overseas travel etc., whereas 50 – 100 years ago, many of these were luxuries reserved only for the very wealthy.

We have never been lived longer, with Australia being the place men live the longest in the world, a fact rarely celebrated.

We have much to be thankful for.

Why is this important for the markets? Because the improvement in living conditions has been largely driven by entrepreneurial ingenuity, fostered by an economic system which encourages and rewards innovation.

Whilst this system remains in place, the world in 3, 5, 10 & 20 years is likely to be a better world than the one in which we now live, and the market forces which allow this to occur will be reflected in the value of businesses which support this endeavour.

We have faced many walls of worry in the past and climbed every one of them. Whilst we can’t guarantee what the market will do in the short-term, we can look at human ingenuity and how markets have performed in the face of previous walls of worry which looked insurmountable.

During March, our managing director, Charles Leyland sat down with Alan Kohler and asked Alan about his life in the media and his opinion of the current market.