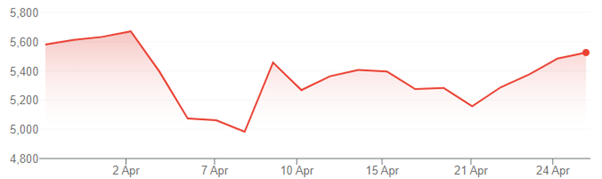

It may surprise many that the ASX finished slightly up for the month, following the drop subsequent to the Trump inspired “Liberty Day” tariff announcements.

ASX200 (1-Month)

The US market has also rebounded from recent lows, but is still down year-to-date.

S&P500 (1-month)

Volatility remains a feature of the share market, as erratic US tariff policy continues to impact confidence and potential earnings. Trump’s recent attack on the US Fed Chair, Jerome Powell, was also unsettling for many investors.

Past 6 Months (US Underperformance)

The Australian market is relatively flat over the past 6 months, when adding dividends to performance. The US market is down about 5% over the same period. European and other ex-US markets have also outperformed the US as funds flow out of US into markets perceived to be more stable. This trend has also resulted in the US Dollar weakening against many currencies, including our own AUD.

Special Mention (CBA)

The Commonwealth Bank of Australia (CBA) is the largest company on our exchange, now representing nearly 11% of the ASX. As at the time of writing, CBA improved 8.5% for the month and for the past 6 months the company is up 15% (excl. dividends). CBA has made a huge contribution to the index.

ASX 200 – TOP 5 (%)

- COMMONWEALTH BANK 10.66%

- BHP GROUP LTD 8.18%

- CSL LTD 5.10%

- WESTPAC BANKING CORP 4.57%

- NATIONAL AUSTRALIA BANK 4.41%

Global Growth

Global growth was recently downgraded to 2.8% by the IMF, the slowest growth since Covid. Lay-offs are accelerating in the US, although a US recession is still not being forecast by markets.

Domestically, inflation is within the RBA target band for the first time in four years. It is expected that central banks will drop interest rates to improve confidence during this time of volatility.

Interest rates are notoriously difficult to forecast, and we prefer to focus on company fundamentals rather than position portfolios for uncontrollable macro events (either positive or negative). Defensive companies with strong fundaments and a history of performance throughout the economic cycle are our preference in most economic conditions, but particularly during times of volatility.

Alex Leyland