The key drivers of the market in 2025 where stock and sector specific as well as the result of macro factors. The list of policy decisions, back-flips and general abundance of information led to volatile markets. Dip-buyers were rewarded as global markets absorbed, or became immune to, the daily inundation of new information – much of which proved to be a distraction. Whilst government and central bank policies can impact company earnings, we encourage readers to focus on company fundamentals. Hyperactive short-term trading is rarely a winning strategy. Patience and a clearly defined strategy should serve investors well over the next year and beyond. Enjoy the journey.

Some key items have impacted markets over the past year and should continue to be dominant going forward:

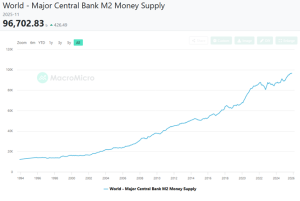

Money Supply

The measuring stick for asset prices is money, and the level of money available impacts asset prices. Our view is that asset price growth is significantly due to money supply.

Global M2 money supply, representing total worldwide liquidity (cash, deposits) from major economies, hit a record high exceeding $22.2 trillion by late 2025. The trend shows rapid expansion after 2023 lows, directly correlating with boosted asset prices, including stocks.

Source: Macromicro (Figures in billions)

Advancements in technology have also improved efficiencies.

Impact of Technology and AI

Geoffrey Hinton, Princeton University, the computer scientist known as "the godfather of AI," said in an interview on CNN's "State of the Union" published Sunday (28/12/25) that AI will have the "capabilities to replace many, many jobs" in 2026. "We're going to see AI get even better. It's already extremely good,"

Geoffrey Hinton won the 2024 Nobel Prize in Physics, sharing it with John Hopfield for their foundational work enabling machine learning with artificial neural networks, the technology behind modern AI.

AI is reshaping corporate productivity, supply chains, and new sector creation, influencing long-term allocators. AI adoption and capital expenditure have supported earnings growth and equity valuations, especially in tech and semiconductor sectors, though concerns are emerging about concentration and valuation risks, particularly in the US market.

Gold (& Silver)

Gold and precious metals saw extraordinary performance as investors sought hedges against geopolitical uncertainty and inflation risk. However, we are not seeing rampant CPI inflation (as calculated by traditional means). Whilst the USD has been weaker this year, it is not outside historical norms. Perhaps the strong performance is due to momentum, attracting new buyers who don’t want to miss out (FOMO). Buying due to momentum is not a long-term strategy.

Alex Leyland