June was another eventful month, particularly from a geopolitical perspective. Offshore, we witnessed an escalation of conflict in the Middle East, followed by a recent ceasefire. Investors appear more circumspect in their approach to the daily news flow, including the prospect of a significant war. During June, the S&P500 rallied about 3%. Domestically, the ASX All Ordinaries gained around 2%.

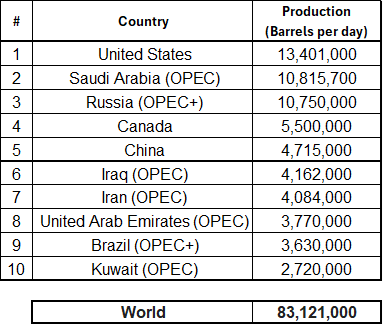

Iran produces approximately 4% of global oil and controls the Strait of Hormuz through which roughly 20% of global petroleum production transits. The initial spike in the oil price, was swiftly reversed following the ceasefire.

Oil Production – Country by Rank (Dec 2024)

Given events over the past month, it would be reasonable to expect the market to drop. In fact, global markets have risen, underscoring the inherent difficulty of predicting macroeconomic events and highlights the risks associated with positioning portfolios based on near-term expectations. Attempting to time the market remains a challenging, and often counterproductive, strategy.

In Australia, the market has seen an increase in corporate activity. Virgin Australia (VGN) re-listed via an IPO, indicating that public markets are open for companies listing at reasonable prices. Another significant IPO during the month was Gemlife, a major Australian land lease community developer, raising $750m and listing early July.

SANTOS (South Australian Northern Territory Oil Search) received a whopping $36 billion takeover bid from a consortium including the foreign government, Abu Dhabi. The bid is subject to regulatory approval, which will likely see the federal government secure domestic supply agreements as a minimum requirement.

The Commonwealth Bank (CBA) continues to rise, confounding many market commentators. Our colleague, Tony Barry, recently wrote an article outlining the reasons why CBA could be considered good value. This is a contrarian view, especially amongst research analysts and market commentators. Feel free to contact us if you would like a copy.

Alex Leyland