The market finished the month relatively flat, down less than 1%. Many companies provided updates at their AGMs, with costs continuing to be in focus. Wage inflation appears to be relatively entrenched, whilst other contributing factors to the inflation calculation are dropping. The cost of energy, for example, is down nearly 14% in the past 6 months.

S&P ASX 200 (1-month)

Brent Crude (6-months)

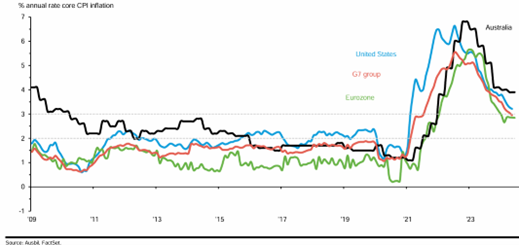

Overall inflation is moderating, and many central banks are now lowering interest rates.

Money supply continues to grow (refer note on CBA contained herein). Currently, inflation appears largely contained in asset prices which are trading around record levels. Elections tend to favour spending, with growth anticipated following the US election.

Cost-of-living and general weakness in the economy is widely reported by the media. Any fall in rates will assist those doing it tough, particularly mortgage holders. However, a weak economic setting appears to be relatively confined and key market indicators do not reflect this issue. For example, bank default rates remain very low.

The Chinese government has also promised additional policy changes aimed at stimulating domestic demand and achieve a 5% growth target, which will improve demand for many Australian exports.

Overall, the economy is performing well. We have a fully employed labour market, with the key issue being filling vacancies. GDP grew in 2024, and it is anticipated to continue to rise next year. Decarbonisation and the energy transition will be commodity demand intensive, a positive for terms of trade.

The items mentioned herein may give rise to issues in the medium to longer-term, but adjusting your risk profile in anticipation of future risks has historically proven to incur significant opportunity costs. The market has risen about 10% p.a. on average over the past 200 years. We prefer to position portfolio to benefit from the structural shifts in the economy, in companies that demonstrate fundamental strength through the cycle.

Alex Leyland