After reporting season ended, the ASX was up approximately 1.5% during September.

Companies able to control costs and maintain or improve margins were rewarded. The Financials sector accounts for about 30% of the ASX, performed well as net-interest-margins (NIM) for the banks remained around 2% and bad-and-doubtful debts didn’t materially deteriorate. Commonwealth Bank (CBA) announced a record dividend of $2.50 a share (fully franked), equating to $4.18billion, the second top payer after BHP.

The Materials sector, which is 20% of the ASX, has fallen as the iron-ore price dropped about 30% since January. The iron ore price has a significant impact on our largest miners with the following contribution to revenue from iron ore being: BHP (65%), RIO (80%) and FMG (100%).

Dividends of over $A34bn have been, or will be, paid to investors between August and October 2024, up 5 per cent on a year ago. Australian companies are expected to pay out over $80 billion in dividends for Financial Year 2024. Major miners again cut dividends, while financials (banks and insurers) paid out more to shareholders.

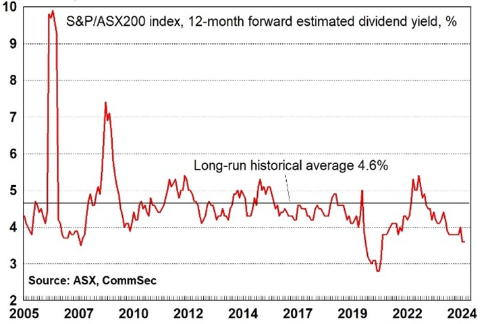

The dividend for the S&P/ASX 200 index is currently 3.6 per cent, below the long-run average near 4.5 per cent since 2000.

Alex Leyland