Markets went up 4% in July, following a weak end to the 2022 financial year. Volume in the market has been very low, as investors await reporting season to ascertain the impact of rising labour, energy and funding costs.

For the first time in 10 years or more inflation, rising interest rates and how central banks will implement policy in relation to these factors are in play

Regarding the consumer, the following appear favourable:

- High levels of household equity (excl. more recent 1st home buyers)

- Tight labour market placing upward pressure on incomes

- Reasonably low levels of consumer leverage (excl. more recent 1st home buyers)

- Strong household savings accumulated during the pandemic

As with anything in economics there is a balance, and the following factors will adversely impact the consumer:

- Inflationary pressures, including non-discretionary items such as energy and food

- Income rises not keeping pace with inflation (spending power reducing)

- Falling home prices, negatively affecting sentiment

- Central banks attempting to impact spending through tight monetary policy (raising rates)

- Increasing likelihood of a recession (if not already here)

Some of the key inputs impacting inflation appear to be moderating, as you may have experienced more recently while filling up your vehicle at the bouser.

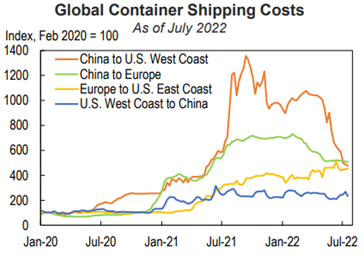

Another example is global container shipping costs, which have come down.

Central bank policies are driving markets at the moment. Reporting season commences next month, which will provide us the opportunity to see the impact of inflationary pressures on earnings.