The first half of the year has seen big movements in numerous markets keeping investors on their toes. The ASX is trading close to all-time highs as are many indices globally. The predicted hard-landing and recession has not eventuated, as governments globally have undertaken stimulatory policy settings and spending money. This printing and spending of money is inflationary and has been a factor in rising financial markets and commodity prices.

ASX200 6 Month Performance

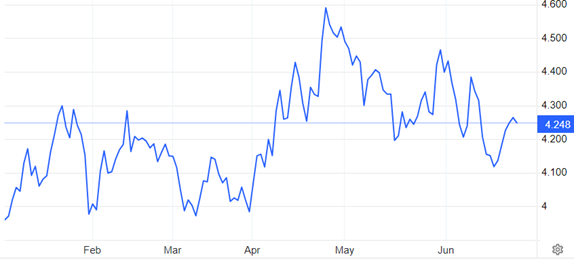

Interest rate forecasts have shifted from down, sideways, to up depending on who you are speaking with. Inflation has remained ‘stickier’ than many anticipated.

Australian 10-Year Bond Yield (6-month chart)

This is also reflected in the rising price of many commodities, particularly silver and gold, as these are seen as a store of wealth and hedge against inflation. Most ‘real’ assets have risen as more dollars chase a finite number of investments.

Globally, mega-cap technology stocks have driven performance in the US. Stocks exposed to Artificial Intelligence (AI) have performed very strongly, as have many downstream companies like Data Centre (DC) operators who store an ever-increasing amount of data. These DC’s require power, cooling, and other services.

The investment community, many with large research capabilities, investment teams, and voluminous reports have not proven any more capable at predicting outcomes than those simply sticking to the basics. Large swings in markets demonstrate that the ‘efficient market hypotheses’, (that all known information is reflected in share prices) doesn’t hold true in practice. Perhaps time would be better spent on the psychology of the market, as opinions tend to cluster in often incorrect areas. An independent thinker can benefit from this.

Alex Leyland