After a fall of nearly 3% in April, the market has rallied nearly 2% in May.

Several market records have been broken recently, with several indices setting new highs.

The Accumulation index is the total return from the top 200 ASX listed businesses, including dividends. Dividends are critical in the domestic market as companies tend to distribute a higher portion of dividends to shareholders rather than investing back into the business for growth. This is due, in large part, to franking credits, making distributions more tax effective. The largest companies in the ASX 200 index are established companies with strong earnings. The top five in order of index weight are BHP (9.54%), CBA (8.40%), CSL (5.85%), NAB (4.60%) and WBC (3.98%).

ASX S&P 200 Accumulation Index (current yield 3.64%)

Companies in the US tend to reinvest earnings rather than paying higher dividends, as capital gains are more tax effective than distributions in that jurisdiction. The result is higher share-price growth. The composition of this index also lends itself to growth with the largest companies being mega-cap technology businesses. The top five in order of index weight are Microsoft (6.83%), Apple (5.84), NVIDIA (5.04%), Amazon (3.78) and Alphabet (2.26%).

US S&P 500 Index (yield 1.28%)

Relative performance

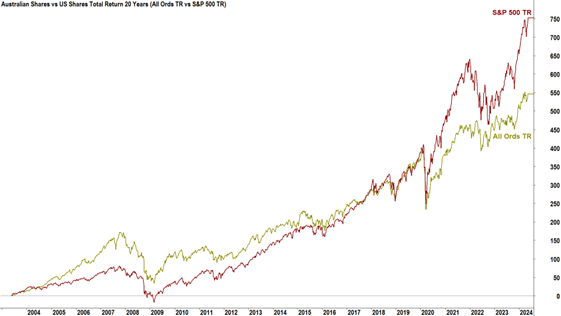

The below chart illustrates the US market outperformance has only been a recent phenomenon (when considered over a 20-year period). This has been driven by the (aforementioned) handful of US tech stocks. The two indexes have vacillated between outperforming/underperforming one another for long stretches.

There is a broader point to make from this chart. The substantial appreciation of both lines over the measured period demonstrates the importance of being invested. There are many ways to skin a cat, but when it comes to investing, time in the market not timing the market is what matters.

Source: Livewire

Commodities have also been very strong, with records being set for gold and copper (not adjusted for inflation).

Gold Futures

Copper Futures

The improvements in these indices, and many more, have occurred in an environment of hyper-analysis of nearly everything impacting global markets.

Again, we suggest owning companies with capable leadership, market strength, sustainable earnings, innovative culture and strong balance sheets, particularly when purchased during difficult periods.

Alex Leyland