The ASX ended the month down about 3.5%.

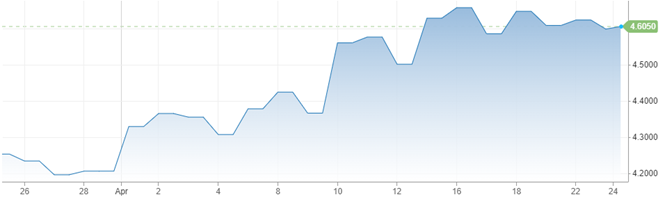

The market drifted lower earlier in the month as tensions in the middle east spiked, then rallied as the threat of escalating war retreated. Whilst this increased tension initially put upward pressure on energy prices (in particular oil), the price has since dropped to finish the month relatively flat. This is significant as the price of energy is a key factor impacting inflation and, in turn, interest rates.

1 Month Crude Oil WTI Chart

The frailty of forecasting interest rates has been on full display. Economists backed away from their firmly held view that interest rates were going to drop significantly. The US 10-year treasury rate has risen sharply indicating that, although rates are expected to fall (3-month US treasury rate is currently 5.36%), the quantum of the anticipated fall has been trimmed.

US 10-year Bond Treasury Rate

Governments around the globe continue to pursue inflationary policies, unable to make politically unpopular policy decisions to reduce debt through increased taxes or reduced spending. The US debt is now around US$35 Trillion and rising, and a new aid package of $US95bn going to the Ukraine, Israel and Taiwan an example of increasing money supply.

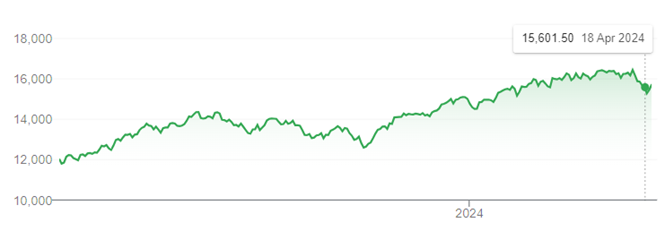

Many of the mega-cap US technology companies had a pull-back recently following a significant rally over the past year (+30%).

Nasdaq Composite Index (1 Year)

Alex Leyland