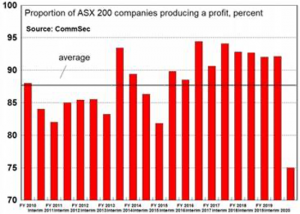

The month saw most ASX listed companies report FY20 numbers, with 75% of companies reporting a profit. This is the weakest outcome in a decade, but encouraging given the economic backdrop. On aggregate, earnings have fallen 37%.

Some stand-out sectors are:

- Gold – strong demand and record prices as investors sort a hedge against inflation

- Iron ore – lifted to a >6 year high given strong Chinese industrial recovery and policy stimulus

- Some retailers – discretionary spending is up 8% as people transition to work-from-home arrangements, as well as spending money from early super release and increased government welfare.

The disconnect between the market and the economy is clearly visible, and one should not be mistaken for the other. The loose monetary policies adopted by central banks are having the desired effect – to maintain growth and asset prices. There is an associated ‘moral hazard’ long-term, as we are not encouraged to take a long-term approach to wealth accumulations, but rather spend what we can now. Historically, this has resulted in either high inflation and/or a credit crunch, as interest rates rise raising the cost of servicing debt. Again, do not mistake the economy from the market. In an inflationary environment, you should be rewarded by owning hard assets (eg: shares).

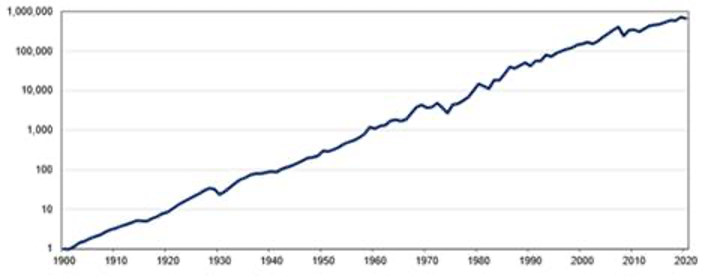

The Australian share market has delivered double-digit annualised returns over the past 100 years, one of the best performing developed economies. Several factors influence this including population growth (+1.4%p.a.), abundant resources, stable democracy and a robust healthcare and education system. Our geographic position in the world should also serve us well given Asia’s ascendancy.

The longer-term an investor is able to view the market, the better off they are as shown in the chart below. Even significant ructions in the market are dwarfed in the broader context of our market. If the past is any indication of the future, this should continue.

ASX All Ordinaries Accumulation Index since 1900