ASX 200 rose nearly 3% during the past month, setting another record high above 9000 points. The year-on-year gain is about 11%, including the impact of ‘Liberation Day’ which now seemed a minor distraction.

Most ASX listed companies have reported FY25 numbers during the month. Companies missing earnings expectations have been punished, even if the miss is only marginal. Interestingly, companies with offshore earnings have felt the impact of tariffs and geopolitics (CSL, JHX) resulting in domestically exposed companies performing better overall. Internationally focussed companies that were able to fully offset the cost of tariffs were rewarded (ANN).

Share buy-backs have been a feature of reporting season (TLS, CSL), despite an increase in overall debt for these companies. Regardless, debt levels are broadly very manageable amongst listed businesses. Profit margins remain a key focus for us, given the downward pressure being reported because of both weaker sales and rising costs, especially in the resources sector.

US Market

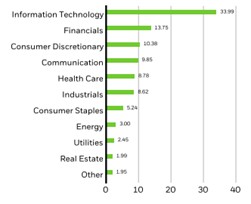

The US market continues to be a driver of global market performance, including the ASX. Mega-cap technology companies are benefitting from the ongoing capital expenditure in Artificial Intelligence which is a key driver of market performance. Whilst large consumer facing companies may be the bell-weather for the US economy, they no longer have a significant impact on market performance. Technology businesses are now 35% of the US index. Remember, don’t confuse the market with the economy. This may change in time, but not at the moment.

S&P 500 – Top 10 Companies

- NVIDIA CORP : 8.06%

- MICROSOFT CORP : 7.37%

- APPLE INC : 5.76%

- AMAZON COM INC : 4.11%

- META PLATFORMS A : 3.12%

- BROADCOM INC : 2.57%

- ALPHABET INC A : 2.08%

- ALPHABET INC C : 1.68%

- BERKSHIRE HATH : 1.61%

- TESLA INC : 1.61%

- Total of Portfolio : 37.97%

Another driver of market performance has been the expectations of further interest rate cuts. The elevated market multiple indicates the market is expecting a number of rate cuts. The ASX 200 is currently about 30 per cent above its long-term average PE multiple of 14.8x. This may be somewhat justified by the increase in money supply, particularly since covid, providing an environment for a new normal. We have commented on this in previous newsletters – let us know if you would like another copy.

In this edition of Leyland Lines, we look at Tuas Limited and Temple and Webster Group Limited. For the video of the month, we include a speech given by Phil Knight, sharing his insights and experiences from his career as Cofounder and Chairman of Nike. Finally, we close with an article written by Morgan Housel titled “What A World (A few Stories)”.

Alex Leyland