In February most ASX listed businesses reported numbers for the first half of Financial Year 2021. Results have been very positive with earnings upgrades, higher dividends and strong cash generation, an outcome few predicted this time last year.

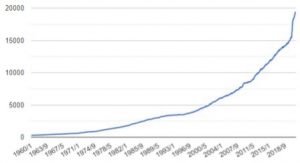

In January 2020 (pre-COVID) the market was rightly concerned about low growth, high household debt levels and susceptibility to rising interest rates. COVID only exacerbated the concern and the market fell sharply. Then came the stimulus, both monetary policy (reducing interest rates) and fiscal policy (government spending). Interestingly, approximately 25% of all currency issued in history has occurred in the past 12 months.

Money supply, billion currency units in the USA, January 1960 - January 2021

Much of this additional cash has found its way into financial assets and bank accounts. Markets have risen, savings rates have skyrocketed, and mortgage interest payment are at a 35-year low despite relatively high debt.

“A nickel ain't worth a dime anymore.” --Yogi Berra

In this edition of Leyland Lines, we look at APA Group, Downer EDI, and PWR Holdings. We include the next series of Berkshire Hathaway annual meeting highlight videos and conclude with an article titled ‘Warren Buffett on the Difference Between Price and Value’.