Rising inflation and interest rates globally have impacted markets, with both equity and bond markets dropping to adjust for the rate rise, increasing the return on cash (risk-free rate of return). The ASX is down about 10% for the month (at time of writing).

Signs of inflation have been clear for some time, and well before the Russian invasion of Ukraine. Energy prices were rising mainly due to political ineptitude resulting in underinvestment in power generation. The global economy was reopening with demand far outpacing supply due to supply chain disruptions. This, along with many other contributing factors, has resulted in a general increase in prices.

Central banks globally appeared slow to act given their mandate to maintain price stability. More recently, central banks have aggressively increased rates to combat very evident inflationary pressures. An effective tool to curtain demand is the ‘wealth effect’, whereby consumers feel less wealthy as asset prices fall (or visa-versa). Additionally, those heavily indebted households will experience an increase in debt servicing, although this appears manageable as unemployment is at record lows and incomes are rising. Consumer confidence is low notwithstanding technically full employment.

In short, interest rates are normalising from emergency settings impacting markets and the consumer. The US consumer accounts for 14% of global GDP, and a large portion of them are under stress (approximately 50% have zero savings). The market is cycling enormous growth.

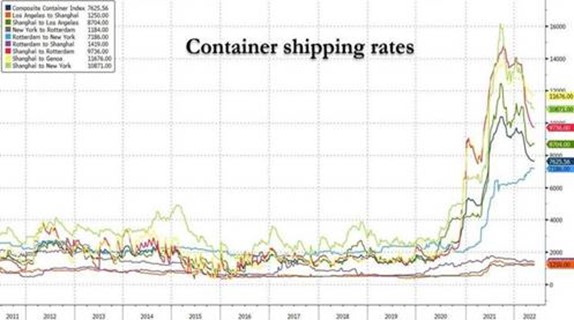

Without attempting to forecast future macro movements, it appears that several factors that have contributed to inflation are now reversing. For example, container shipping costs have dropped sharply.

Shipping freight costs:

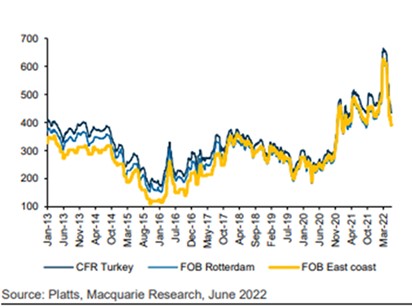

Scrap metal prices have also fallen:

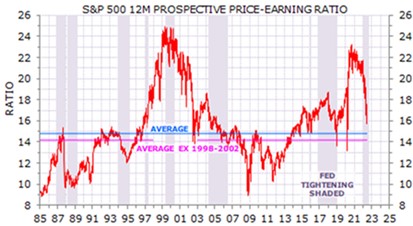

Equity valuations have returned to what is considered ‘normal’.

If earnings can be maintained, or fall only slightly, valuations appear reasonable. The valuation gap between the return on equities versus that of cash (risk-free) has been maintained. High quality large-cap companies have been sold off in what is a broad market retracement. These companies have weathered numerous cycles and should do so in this instance. When things become clearer, share prices will adjust accordingly.

Finally, China remains a key factor, as it commences an interrupted reopening, freeing up of supply chains (Shanghai is the largest freight terminal globally) and increasing demand for commodities.

The market tends to overshoot in both directions. The pending end-of-financial year results will tell an interesting story.