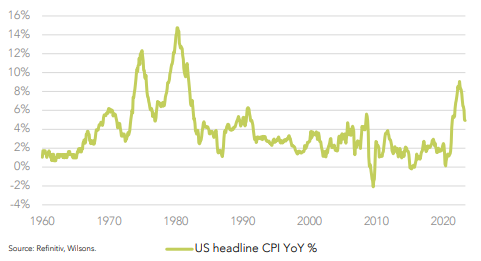

During the month the ASX200 was relatively flat as investors focused on events in the US. The US inflation rate fell from 8.4% to 4.5%, which may result in the US Federal Reserve reducing the velocity of rate rises or leaving rates unchanged. Any curtailment of rate rises should positively impact the share market as competing asset classes, like cash, become relatively less appealing. However, the current rate of inflation is still above the central bank’s target of 2% signalling that rates could rise further if inflation remains elevated.

Much of the retracement in inflation has been due to falling input costs. For example, the price of energy has fallen significantly during the past few months.

Global Price of Energy Index

Another major input cost is labour, which has been increasing, although real wages (adjusted for inflation), are reducing.

The Producer Price Index (PPI) is an index that measures the average change over time in selling prices received by producers of goods and services. PPI measures price changes from the perspective of the seller. The US PPI has come down significantly to more normalised levels.

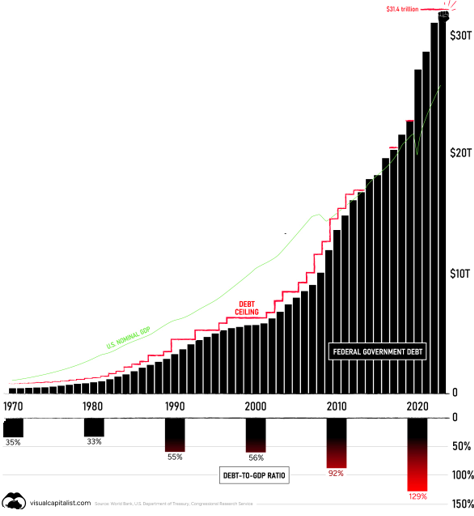

Another hot topic during the month has centred around US government debt, and negotiations to increase the debt ceiling. The debt ceiling is a limit on the amount of money the US government can borrow to funds its operations. The US currently has $US31.4 trillion in debt.

Regardless of the level of US government debt, the US Dollar is still considered a safe alternative when perceived risks in the broader global economy are heightened. In the recent past, the USD has appreciated against nearly every other currency.

To name a few of the countries with currencies recently collapsing: Egypt, Venezuela, Pakistan, Lebanon and Nigeria. They share a characteristic of virtually no pricing power outside their country and very litter internally. Inflation is a natural consequence.

Over the last two years even major currencies have fallen vs the USD. For instance:

- AUD -10%,

- GBP -9%,

- Canadian dollar 6%,

- Chinese Renminbi -6%,

- Indian Rupee -11%,

- Euro -13%

- Japanese Yen -23%

Alex Leyland