The market has risen about 2.5% during the month, driven largely by the outcome of the US election on November 5th which correlates with many historical post-election trends.

Inflation

Elections tend to favour spending regardless of the outcome. Specific Trump policies that may add to inflation include increasing tariffs (raising cost of goods) and deportation programs (raising cost of services).

Tax

Trump’s tax policy is anticipated to include extending his 2017 tax overhaul, with a few notable changes that include lowering the corporate income tax rate to 15% from the current 21%. He is also expected to roll-back income tax hikes for wealthier Americans and scrap the Inflation Reduction Act policies designed at combatting climate change.

S&P ASX 200 (1-month)

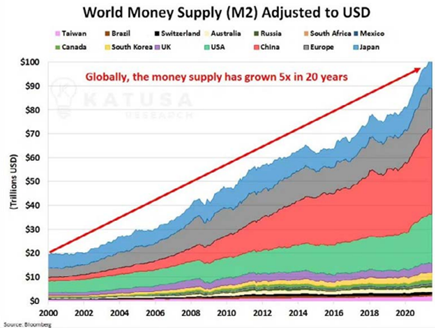

The market continues to set new record highs, which has given rise to many questioning valuations. We mentioned in last month’s newsletter the increasing money supply, which has an inflationary impact on asset prices.

To recap “The graph below shows that not only is total money supply increasing, the rate at which it is increasing is speeding up! Two things that are affected by this growth are asset values and money availability.”

“The Dow Jones and the S & P indices are up approximately 4-fold over the same time frame global money supply is up 5-fold. A case could be made that the markets are undervalued on this comparison.” – Tony Barry (Leyland Private Asset Management).

The increasing money supply is supportive to asset prices, across most asset classes. Investors can have short memories, and the recent leg-up in asset prices has seen many focus far more on returns than on risk.

Alex Leyland