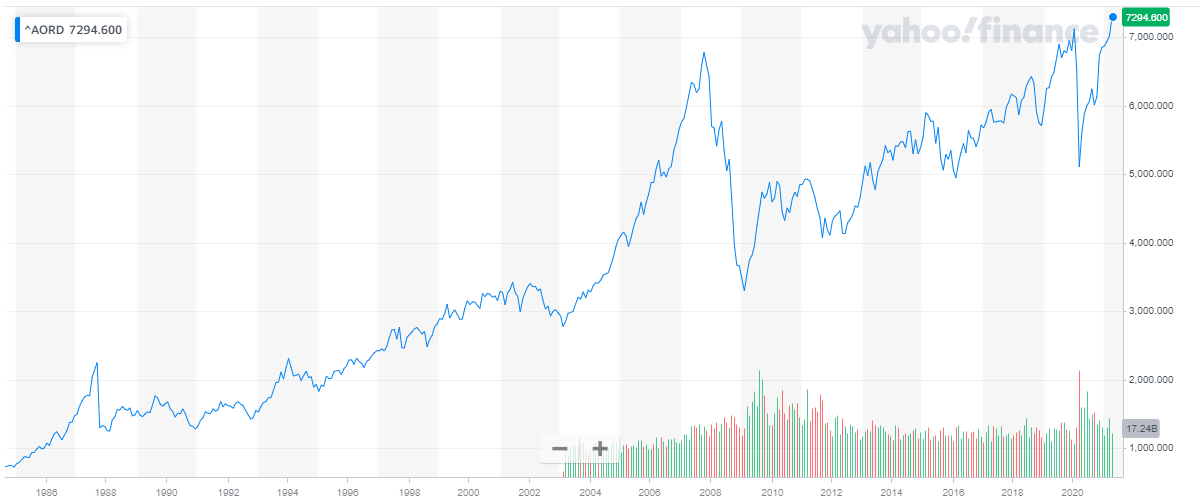

Much has been made of the market hitting all-time highs recently; accompanied by the normal predictions of pending catastrophe.

Many great investors have discussed the folly in making market predictions. Amongst the many comments on this exercise of looking into crystal balls is one from John Templeton:

“The influence on stock prices are so numerous and so complex that no person has ever been able to predict the trend of stock prices with consistent success.”

Anecdotally, many businesses are booming at present. The injection of built-up savings due to covid into the money supply appears to be working.

In the USA - Microsoft, Google, Apple & Facebook have all delivered results in the past week far exceeding even the most optimistic expectations.

Unemployment in Australia is approximately 5%, which has traditionally been considered ‘full-employment’; The government is trying to bring this excellent figure even lower, notwithstanding the large number of unfilled job advertisements. In fact, Seek Ltd (mentioned later in this newsletter), is posting record numbers of jobs.

Interest rates are at an all-time low.

Inflation is low.

These figures are as close to ‘perfect’ as any economist might imagine.

The massive global stimulus also provides cause for short term optimism.

Of course, we also think that most bull-markets die on euphoria.

Predicting markets is a conundrum and an activity which one should not engage in if they want to sleep well at night.

A good night’s sleep is had if one looks at a portfolio as a list of businesses which they wish to own throughout all market cycles. If ‘Mr. Market’ provides a chance to purchase additional businesses at low prices, all the better.