The past month has seen most ASX-listed businesses report first half (FY22) numbers, broadly demonstrating strong corporate earnings in nearly every sector.

The rate of companies beating expectations is currently at 55%, versus 33% historically. Only 14% of companies have missed analyst forecasts. A particular highlight being the ability of high-quality businesses to pass through cost pressures onto customers, while maintaining or even increasing profit margins.

Pleasingly, the ASX has been the best performing global market this month, so far.

In a continuation of recent themes, markets attempt to make sense of seemingly less-than-transient inflation and the potential for interest rates to rise. Add to this geopolitical tension in Ukraine and energy prices making for a volatile start to the year.

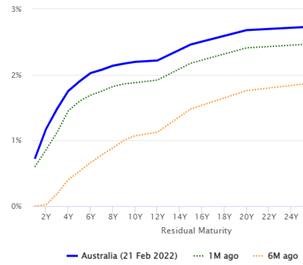

The following chart demonstrates the recent steepening of the yield curve. The bond market now anticipates the yield on government bonds to be far higher than anticipated 1 or 6 months ago.

The RBA continues to convey a policy of no short-term interest rate movement, whilst the market is predicting a rise in nearly every RBA meeting this year.

There is rarely a dull moment in capital markets. Many of these macro issues (and others) have only limited impacts on company earnings, and certainly not to the extent that is reflected in share-price volatility. Speculators will try to make sense of all this, reacting in whatever way they see as being potentially profitable. Our view is that the market gravitates to quality in these conditions, and a long-term bias is generally financially rewarding.