During May, the market was broadly flat. The outlook for the domestic economy appears robust:

- Household and corporate balance sheets are strong.

- Elevated retail spending.

- 20-year high job vacancy rate should result in lower unemployment.

- Australian government debt remains manageable.

- Interest rates are at record lows.

- Business forward orders recently reached multi-decade highs; and

- Strong commodity prices translating into strong national terms-of-trade.

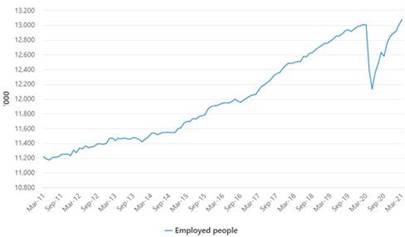

Australia’s accelerated emergence from the depths of the 2020 recession are demonstrated in the graph below which plots population employment numbers through time.

Australia – Number of Employed

Add to this the extremely stimulatory federal budget and everything would appear just ideal, which is exactly the problem. In economics there is always a trade-off, and in this case, it is the prospect of inflation. Central banks continue to operate under the premise that any observable inflation will likely be transitory. Anecdotal evidence suggests that prices and wages are rising at a far greater pace than central banks would have you believe. Rising inflation normally results in increasing interest rates, which acts as a hand-break for the economy and asset prices. This is the cycle.

Accurately predicting the outcome is challenging and positioning a portfolio for potential outcomes even more so. Profitable businesses with pricing power and capable management should perform relatively well in most markets, including in an inflationary environment. The market will always be short-term focused, volatile and reactionary. As an investor, you can benefit from this: own good businesses, monitor them and hold for the long-term.