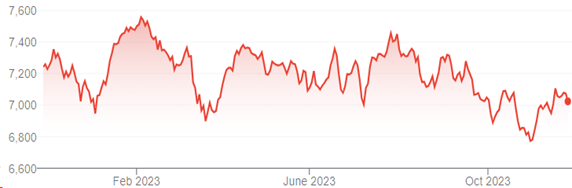

The ASX has risen approximately 3% in November, following a negative October, ending in a relatively flat position over the past two months. By way of comparison, the US S&P500 is up about +10% for the month of November. In $AUD terms the US market is up about 4% for the month of November after adjusting for currency movements.

US S&P 500 (excl distributions) – 1 year Chart (+13%)

The US market has performed well, in part, due to the composition of the index (more mega-cap technology stocks) as well as lower anticipated inflation which is impacting interest rate forecasts. In late October, the interest rate on the US 10-year bond touched 5% but has since fallen to 4.4% indicating that the market believes US inflation is abating.

America – 10-Year Bond Rates

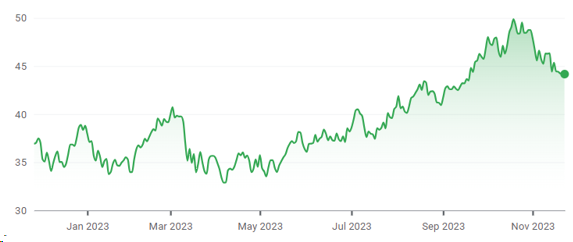

Australia S&P ASX 200 (excl distributions) – 1 year Chart (-2.9%)

The Australian market is concentrated largely in the financial (banks) and materials (resources) sectors. The performance of these sectors is reflected in the performance of the ASX index, below that of large US companies. Given sector concentration in the ASX, we advocate for active management of a share portfolio over an index approach, resulting in improved diversification and risk adjusted returns.

Australia 10 Year Bond Rates

In Australia, the 10-year bond rate has also fallen, although not to the same extent as the US.

Alex Leyland