The past month has seen the market drift sideways, which was beneficial to investors as many companies went ex-dividend following FY23 reporting season. In fact, there is about $43bn of cash due to be paid out in dividends during September and October. Company share prices tend to drop on ex-dividend date by roughly the quantum of the dividend, so a relatively flat market indicates resilience during this period. An additional $43bn injection should be supportive of equities in the near-term.

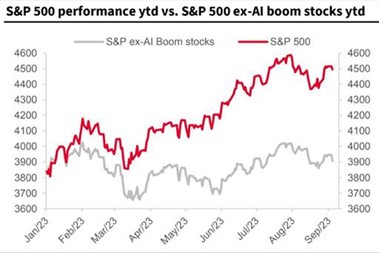

A theme continuing to gain traction is the impact of Artificial Intelligence (AI) and increasing demand for goods and services relating to this sector. The chart below indicates the impact that this has had in the US market, with most of the recent strength in the market being attributable to companies involved in AI.

The Chinese economy has also been in focus, with a recent survey by the Bank of America indicating expectations of a challenging period ahead.

In fact, India has supplanted China as the world’s most populus country.

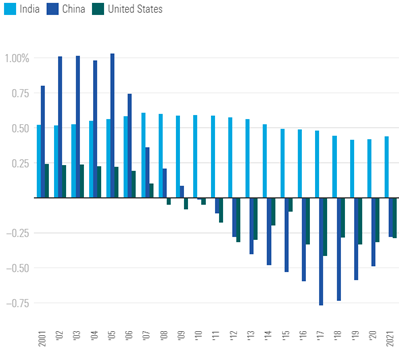

India’s working age population continues to grow as the labour force in China and the US shrinks. A growing working-age population has allowed the country’s pace of economic output to keep up with historically wealthier peers.

Annual Change in Population: Ages 15-64

The topics mentioned above are things to consider when shaping investment decisions. Themes can take a lot longer to play out, and investing in long-duration themes often result in a poor financial outcome. Individual investors cannot influence macroeconomic factors and do far better focusing on the microeconomic factors driving individual companies.

Alex Leyland