During the past month, many ASX-listed businesses reported FY23 earnings. So far, there have been a relatively even spread of ‘beats’ versus ‘misses’. The share price movements have been significant post-reporting, both on the up and down side. The companies that have performed well have demonstrated strong margins and earnings. Surprisingly, discretionary retail has outperformed (~70% beating expectations) due to low expectations going into reporting season as a function of cost-of-living pressures. Company guidance has softened, especially in the Real Estate Investment Trusts (REITS) due to the impact of higher interest rates, falling occupancies & valuations. More defensives have underperformed with some earnings misses, although only slightly versus expectations.

Persistent inflation has contributed to bond yields continuing to rise. The US 10-year bond hit a 16-year high during the month.

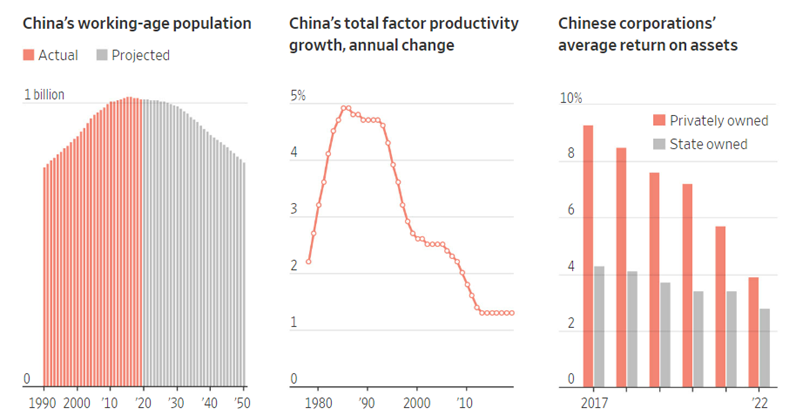

Another topic of increasing concern is the state of the Chinese economy, particularly the property sector. Following on from the bankruptcy of Evergrande, another large developer, Country Garden, is also under financial stress. The Chinese economy impacts Australia’s, as they are the largest consumer of our raw materials, iron ore in particular. On a positive note, India is relatively early into its transformation, and could foreseeably supplant Chinese demand.

Alex Leyland