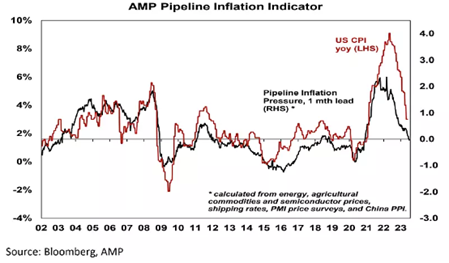

The ASX rose 3% during July, as US inflation pressures continued to ease, providing the catalyst for the US market to rise and for the ASX to follow. US inflation has fallen from 9.1% to 3% in the past 12 months, with indicators predicting this to continue. Notably, many of the inflation inputs which declined are not overly impacted by interest rates (more supply-side factors). For example, lower commodity prices (energy in particular) and improving transport costs because of more efficient supply chains post-covid. Interest rates have impacted demand, which has also fallen. The price rises of both goods and services appear to be moderating.

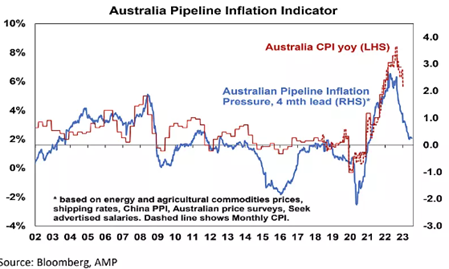

The Australian economy tends to lag the US by about 6 months, which may see the RBA relaxing its tightening bias. A drop in unemployment to ~3.5% appears to be inflationary (62,000 new jobs added) but the inflation momentum appears to the downside. The RBA may get its wish of low inflation and low unemployment, due mainly to factors outside its control. On July 26, our inflation rate (CPI) came in at 6% annualised (versus 6.2% expected) reducing pressure for further interest rate rises.

The market performs well during periods of stability as confidence levels return. Confidence tends to peak at the wrong times, as unknown risks are never too far away. Macro movements, inflation, interest rates, currency movements and many other indicators are difficult (at best) to predict. Positioning a portfolio for a certain outcome can be troublesome, especially if based on a consensus view. Holding quality businesses through turbulent periods and not succumbing to the crowd will pay strong dividends over the long term.

Alex Leyland