The month of May provided much to consider. The election result had little bearing on the Australian market, as the key drivers appear to be global macro-driven capital flows as a function of forecast inflation and interest rates. Overall, the market was down -2.5% this month and broadly in-line with global movements.

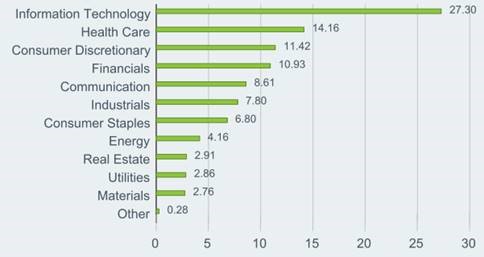

The high growth sectors, technology in particular, were impacted significantly from these movements. In the US, the largest companies are mega-cap technology businesses which have had an outsized impact on the major indexes. Since the start of the year the S&P 500 is down about 15%. The tech heavy NASDAQ is down around 25% (bear market).

S&P US 500 – Sector Breakdown (%)

S&P US 500 – Top 10 Holdings (%)

| APPLE INC | 6.98 |

| MICROSOFT CORP | 5.94 |

| AMAZON COM INC | 3.1 |

| TESLA INC | 2.08 |

| ALPHABET INC CLASS A | 1.96 |

| ALPHABET INC CLASS C | 1.82 |

| BERKSHIRE HATHAWAY INC CLASS B | 1.69 |

| UNITEDHEALTH GROUP INC | 1.37 |

| JOHNSON & JOHNSON | 1.36 |

| NVIDIA CORP | 1.32 |

| TOTAL | 27.62 |

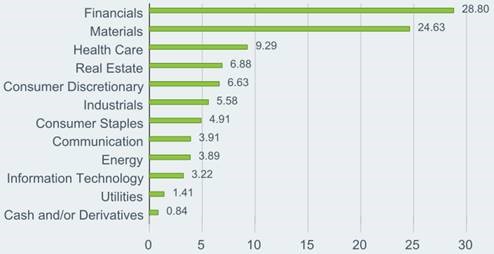

Whilst the technology names in the domestic market were impacted, the index was largely protected due to the concentration in the banking and resources sectors. The ASX is down about 3% over the same period (since 1 Jan).

S&P ASX 200 – Sector Breakdown (%)

S&P ASX 200 – Top 10 Holdings (%)

| BHP GROUP LTD | 10.97 |

| COMMONWEALTH BANK | 8 |

| CSL LTD | 5.91 |

| NATIONAL AUST BANK LTD | 4.78 |

| WESTPAC BANKING CORP | 3.77 |

| ANZ BANK | 3.47 |

| MACQUARIE GROUP | 3.37 |

| WESFARMERS LTD | 2.53 |

| TELSTRA CORPORATION LTD | 2.14 |

| WOOLWORTHS GROUP LTD | 2.11 |

| TOTAL | 47.05 |

The concentration in the domestic index gives rise to sector specific risks, which can be reduced through an actively managed portfolio. Company fundamentals are critically important, as we have seen recently with the significant share-price retracement in unprofitable businesses, often in the technology sector. In these markets quality is key (as opposed to share price momentum for example).