The market surprised many with its resilience during the month, against a backdrop of tighter monetary policy and cost of living pressures.

The cash position held by fund managers is at all-time highs, as is the net short position held by hedge funds. Clearly, many investors are anticipating a drop in the market. As is often the case with investing, the opposite of what you would expect to occur comes to fruition and this is normally a bullish scenario.

The next few months will be particularly interesting as companies report financial year results and, potentially more importantly, provide guidance on anticipated future earnings. The defensive positioning of portfolios led to the outperformance of ‘value’ versus ‘growth’. Large-cap established businesses have outperformed the smaller early stage companies, especially those that are not profitable. Rising interest rates, and the increased returns in very defensive asset classes (eg: cash) means that investors don’t require additional risk to achieve targeted returns. Given the improved returns from fixed income instruments, investors are well served by ensuring all aspects of their portfolio are performing optimally, including the rates of interest received on cash.

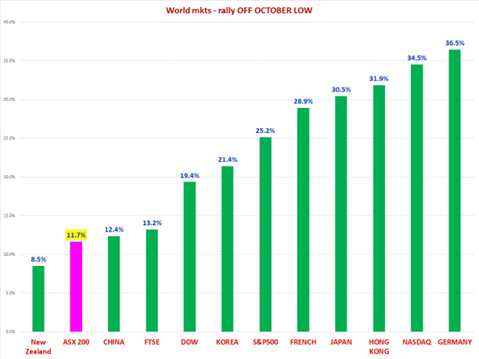

It is however, worth noticing how much the Australian market has lagged international markets. Notice the outperformance of the tech-heavy NASDAQ (34.5%) vs the S&P500 (25.2%), both of which capture US listed stocks. This is telling of the market’s enthusiasm for all things AI and tech-related. AI happens to be the theme for this month’s newsletter.

The Coppo Report

The market will have its ups and down, it always does, “we have no idea — and never have had — whether the market is going to go up, down, or sideways in the near or intermediate-term future.” – as Warren Buffett once quipped, and positioning a portfolio for a potential fall in markets has historically proven unrewarding. A level of discomfort generally provides a reasonable basis for success.

There are always risks to investing, which is why shares have outperformed all other asset classes over the long-term, and when ‘Mr. Market’ is nervous, value investors can do very well.

As always, we recommend a diversified portfolio of quality businesses and a long-term investment view. Additional risk is simply not required at the moment.

Alex Leyland